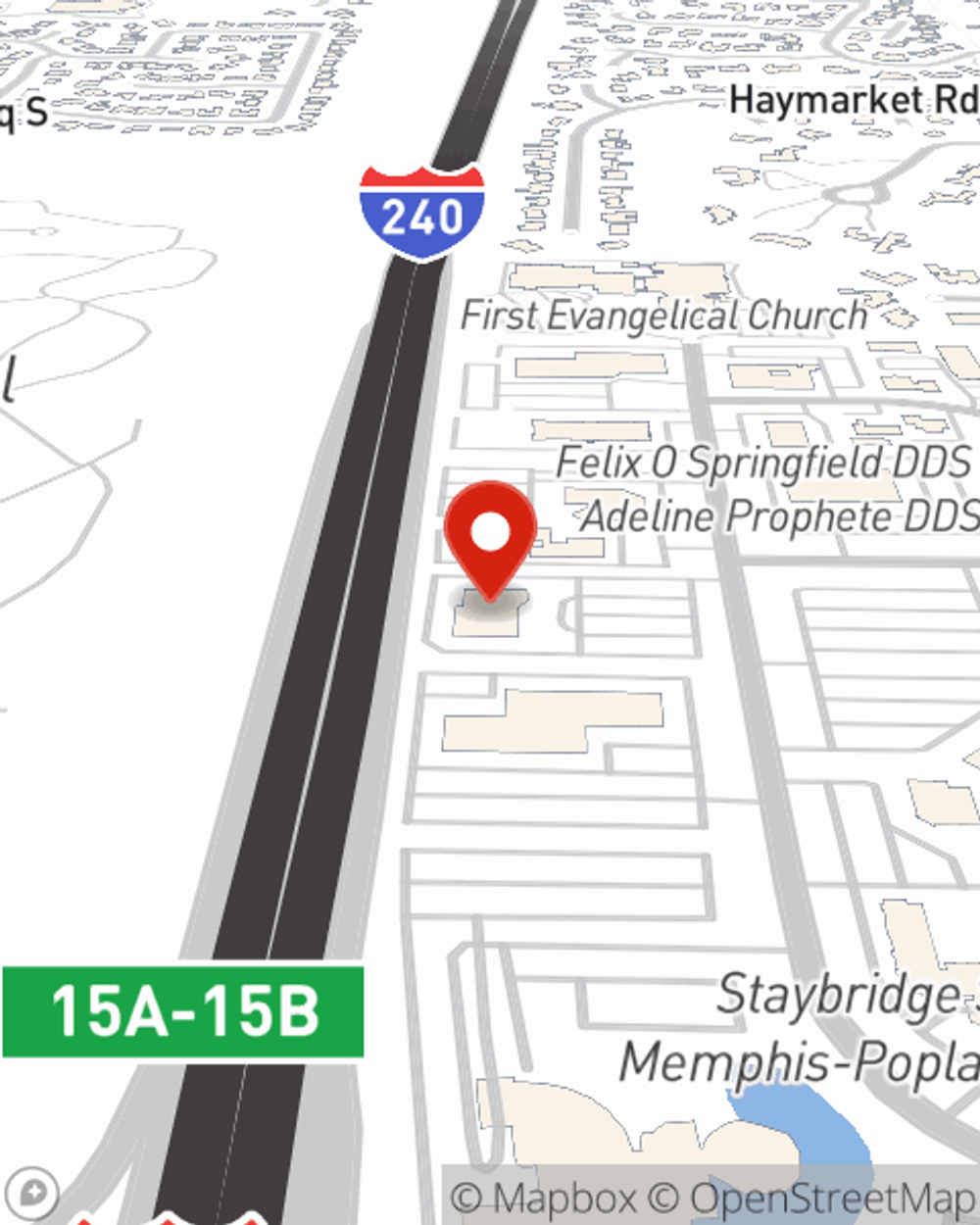

Homeowners Insurance in and around Memphis

Looking for homeowners insurance in Memphis?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

- memphis

- germantown

- collierville

- cordova

- bartlett

- lakeland

- millington

- Southaven

- olive branch

- west memphis

- clarksville

- rossville

- atoka

There’s No Place Like Home

Everyone knows having fantastic home insurance is essential in case of a windstorm, fire or tornado. But homeowners insurance is about more than covering natural disaster damage. An additional feature of home insurance is its ability to protect you in certain legal situations. If someone gets hurt in your home, you could be held responsible for the cost of their recovery or their medical bills. With adequate home coverage, these costs may be covered.

Looking for homeowners insurance in Memphis?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Protect Your Home Sweet Home

Homeowners coverage like this is what sets State Farm apart from the rest. Agent Wesley Channels can be there whenever you have problems at home, to get you back in your routine. State Farm is there for you.

Let us help with the details of insuring your house with State Farm's outstanding homeowners insurance. All you need to do to lay the foundation is visit Wesley Channels today!

Have More Questions About Homeowners Insurance?

Call Wesley at (901) 767-2001 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Boost your home pool safety

Boost your home pool safety

Safety reminders and guidelines to make sure your swimming pool or hot tub is ready for the season.

Wesley Channels

State Farm® Insurance AgentSimple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Boost your home pool safety

Boost your home pool safety

Safety reminders and guidelines to make sure your swimming pool or hot tub is ready for the season.